UPDATE: Bibb County School Board adopts 14.674 millage rate, raising property taxes

Although the millage rate remains the same, the decision will lead to higher property taxes for homeowners due to increased property values.

UPDATE (9/10): The Bibb County School Board voted Tuesday to adopt a final millage rate for Calendar Year 2024 / Fiscal Year 2025, maintaining the current millage rate of 14.674 that was tentatively adopted last month.

ORIGINAL STORY (8/19):

MACON, Georgia (41NBC/WMGT) – The Bibb County Board of Education tentatively adopted a millage rate of 14.674 mills for the 2024 calendar year/2025 fiscal year on Monday, keeping the rate unchanged.

Although the millage rate remains the same, this decision could lead to higher property taxes for homeowners due to increased property values. For a homeowner with a property valued at $200,000, the district estimates this could mean an increase of less than $5 a month, or just shy of $60 per year.

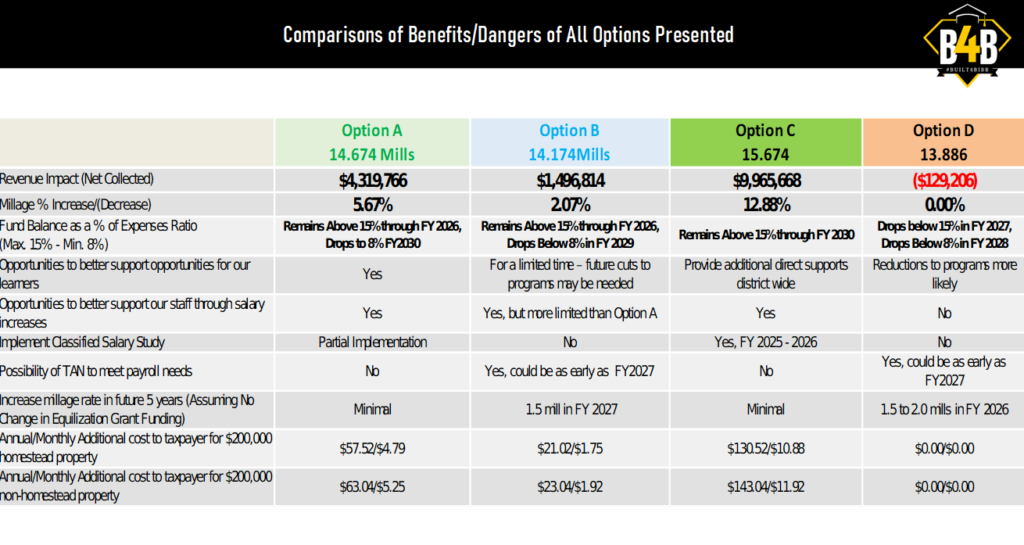

The District received the CY 2024/FY 2025 tax digest from the Bibb County Tax Commissioner’s Office last week. Based on the tax digest from the Bibb County Tax Commissioner, the rollback millage rate is 13.886 mills. These findings were presented to the Board of Education on Thursday, with the following preliminary millage rate options to consider ahead of Monday’s meeting:

- Option A: Maintain current millage rate of 14.674 mills (estimated additional revenue of $4.32 million for FY 2025 budget; estimated annual property tax increase of $57.52 for a homeowner with a property valued at $200,000)

- Option B: Rollback of .50 mills to 14.174 mills (estimated additional revenue of $1.5 million for FY 2025 budget; estimated annual property tax increase of $21.02 for a homeowner with a property valued at $200,000)

- Option C: Increase by 1 mill to 15.674 mills (estimated additional revenue of $9.97 million for FY 2025 budget; estimated annual property tax increase of $130.52 for a homeowner with a property valued at $200,000)

- Option D: Full rollback of.788 mills to 13.886 mills (estimated revenue loss of $129,206 for FY 2025 budget; estimated annual property tax increase of $0 for a homeowner with a property valued at $200,000)

The District says the millage rate decision will determine the level of funding it has available to continue to support current and/or new education programs, schools, employee salaries and staffing levels, mentioning in Monday’s Board Brief that it “could position the District to better compete with surrounding Districts’ salaries, impacting recruitment and retention efforts for FY 2025 and beyond.”

To view Monday’s full presentation, which ended with the tentative adoption of “Option A,” click here.

During Monday’s meeting, the board discussed risks associated with lowering the millage rate.

“It was also noted during the meeting that lowering the millage rate to the full rollback rate could put Bibb County School District at a risk of losing important equalization funding,” the Board Brief stated. “The amount of equalization funding BCSD receives varies each year and is based on a state-calculated algorithm determined by economic factors. Currently, CFO [Eric] Bush estimated, Bibb County sits somewhere around a total 17-mill mark for this equalization algorithm. If BCSD were to rollback its millage rate, it could position the District dangerously close to a 14-mill baseline. If the county dips below the 14-mill total baseline, Bibb County School District would no longer qualify to receive equalization funding – something that would strain the District’s overall fund balance by millions. As an example, this year BCSD received about $23 million in equalization funds, while last year BCSD received about $12 million in equalization funds.”

Since board members chose “Option A” of maintaining a millage rate of 14.674 mills, three public hearings must be held. These hearings are required under state law if a millage rate higher than a full rollback is proposed.

- Public Hearing #1: Tuesday, September 3, 2024, at 11 a.m. at the Professional Learning Center at the Martin-Whitley Educational Complex, 2003 Riverside Drive, Macon, GA

- Public Hearing #2: Tuesday, September 3, 2024, at 6 p.m. at the Professional Learning Center at the Martin-Whitley Educational Complex, Macon, GA

- Public Hearing #3: Tuesday, September 10, 2024, at 5 p.m. at Central Office, 484 Mulberry Street, fourth floor Board Room, Macon, GA

The called meeting for final adoption is set for Tuesday, September 10 at 5:30 p.m. in the fourth floor Board Room at 484 Mulberry Street.

For more information about participating in the public hearings, read Board Policy BCBI: Public Participation in Board Meetings on Simbli here. A copy of the Request to Address the Board Form may be found on Simbli here.

Review the FY 2025 budget

Click here to review the FY 2025 Recommended Budget presentation. Click here to see the action item for the approval of the FY 2025 Recommended Budget.