Morning Business Report: Stock futures take a sharp dive as tariff conflict continues

Stock futures took a sharp dive overnight, with the Dow Jones Industrial Average dropping 1,500 points as the tariff conflict continues to escalate.

(LILAMAX)- Stock futures took a sharp dive overnight, with the Dow Jones Industrial Average dropping 1,500 points as the tariff conflict continues to escalate. The Wall Street Journal reports that around 50 countries have reached out to the White House seeking to begin negotiations on tariffs, but Commerce Secretary Howard Lutnick has made it clear that the tariffs will not be postponed.

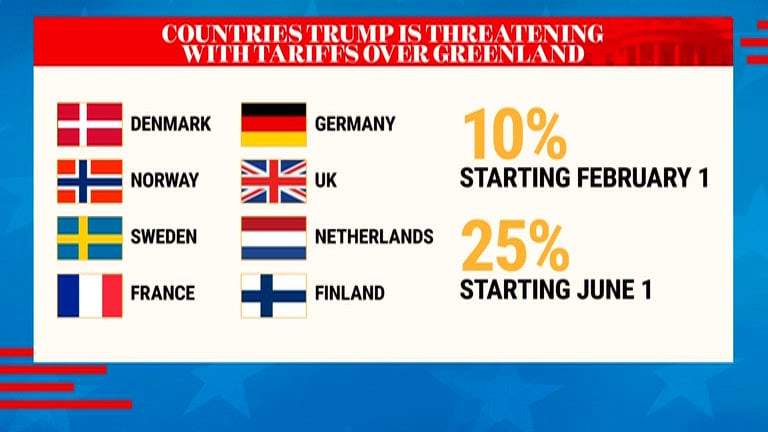

The new 10% tariff on nearly all U.S. imports, which took effect on Saturday, is expected to impact most nations, with rates set to rise for some countries in the coming days.

Meanwhile, many Americans are delaying major life decisions in light of economic uncertainty. According to Business Insider, fears of a recession and rising student loan concerns are leading people to postpone purchasing homes, starting families, and pursuing business ventures or career changes due to job insecurity. Additionally, tariffs are expected to drive up prices on everyday items, including groceries and cars.

On Friday, the Dow closed down 2,200 points, and the Nasdaq entered bear market territory amid the fallout from the escalating trade dispute. As of Friday’s close, the stock market has lost more than $6 trillion in value, signaling ongoing turbulence for investors.

April is Financial Literacy Month, making it the ideal time to explore new tools and resources to help manage finances. Adam Davis from Capital One shared that the company is partnering with Khan Academy to offer financial education tools for people throughout their lives. Those interested can visit Capital One’s website for more information.

In other financial news, a new survey conducted by Talker Research for National Debt Relief reveals that both Generation Z and Baby Boomers are concerned that debt is jeopardizing their retirement plans. The survey found that the largest barrier to paying off debt for those polled was insufficient income. Credit card debt was the most common source of debt, with the average respondent carrying a balance close to $9,000 and paying $418 per month toward it.