What the payroll tax holiday would mean for you

President Trump’s executive order calls to suspend the payroll tax, but the impact that it could have on your future tax returns has left many confused. NBC’s Dan Scheneman reports.

(NBC News) Economic experts are warning that President Trump’s executive order suspending the payroll tax could have a major impact on your future tax returns.

The order defers the roughly six-percent tax, which employers usually withhold every time you get paid.

That money is not like the stimulus checks that Americans received earlier this summer as part of the $2 trillion CARES Act.

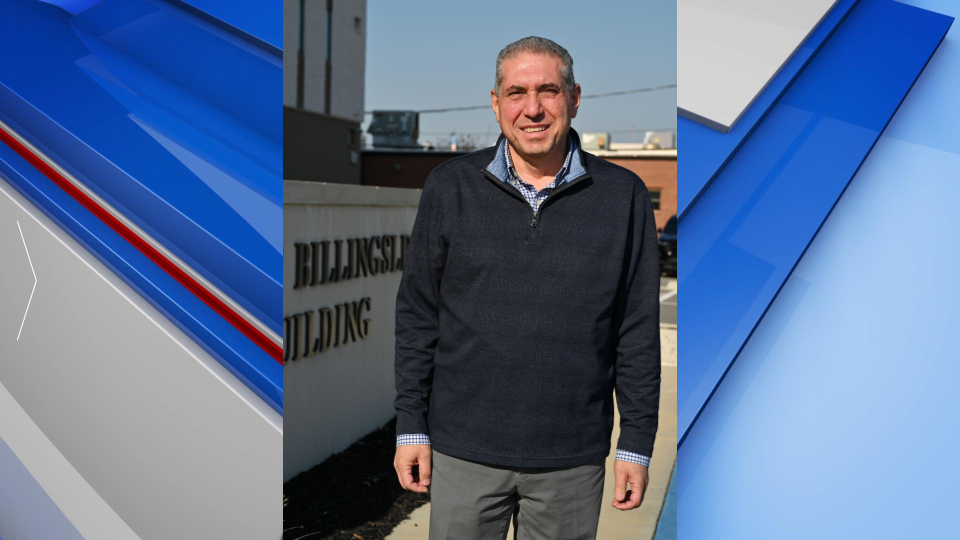

“We’re not getting a tax cut with this,” explains Bankrate.com Senior Economic Analyst Mark Hamrick. “We’re simply delaying the collection of a tax which is basically collected among employees on an ongoing basis to fund the Social Security system.”

That delay could add up to thousands of dollars you will have to pay back.

“You’re not getting essentially the elimination of the tax,” Hamrick says. “You’re simply being told you’re going to have to pay this at the first of the year.”

Hamrick says the administration designed the executive order to help those Americans who are collecting a paycheck, but not the more than 10-percent currently unemployed.

The president signed this and other executive orders because congress has been unable to agree on a second stimulus package.

“Republicans don’t like the idea of payroll tax cut for the very same reason that don’t and that it doesn’t solve the problem,” Hamrick notes.

Hamrick says if the legislation goes through, employees should try to save that money for the eventual tax bill.

Read more: https://nbcnews.to/30IJXNI

Leave a Reply