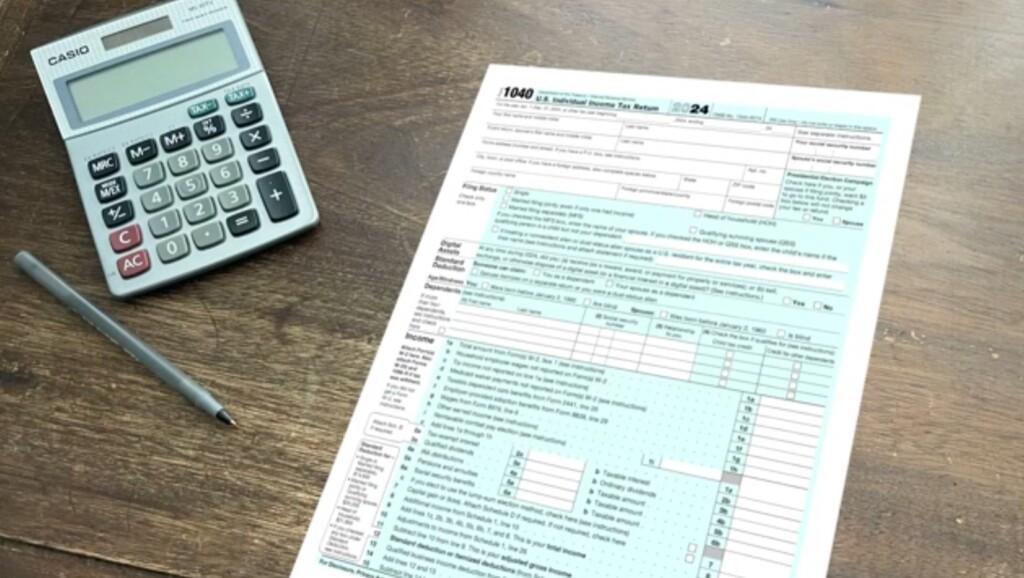

Tax season: Filing deadlines, refund tracking, and free IRS programs

The IRS expects 140 million tax returns by April 15. Learn about refund timelines, the expanded Direct File program, and how to file for free.

(CNN)- Tax season is officially underway, and the IRS expects 140 million taxpayers to file their returns by the April 15 deadline.

For those expecting a refund, the IRS advises that filing electronically is the fastest way to receive your money—typically within 21 days. Choosing direct deposit can speed up the process even further. However, taxpayers filing paper returns should expect a longer wait, with refunds potentially taking four weeks or more.

To help taxpayers track their refunds, the IRS provides the “Where’s My Refund?” online tool. Those who e-file can check their refund status within 24 hours, while paper filers may need to wait up to four weeks for updates.

New Free Filing Options

This year, the IRS has expanded its Direct File program, which now allows taxpayers in 25 states to file their taxes directly with the agency—free of charge. Last year, the program was available in only 12 states as a pilot initiative.

Direct File enables taxpayers to calculate and submit their returns using their W-2s without relying on commercial tax preparation software.

Additionally, IRS Free File remains available for individuals with an adjusted gross income of $84,000 or less. This program provides access to various tax filing software options from IRS partner companies.

For more details on these programs and answers to common tax questions, visit IRS.gov.