Key economic reports may shape next Federal Reserve rate decision

Economic reports expected today could play a major role in shaping the Federal Reserve’s next interest rate decision.

(CNN)- Economic reports expected today could play a major role in shaping the Federal Reserve’s next interest rate decision. The new data includes updates on home sales, mortgage rates and the long-delayed September jobs report — a key indicator for the Fed’s dual mandate of maximizing employment while controlling inflation.

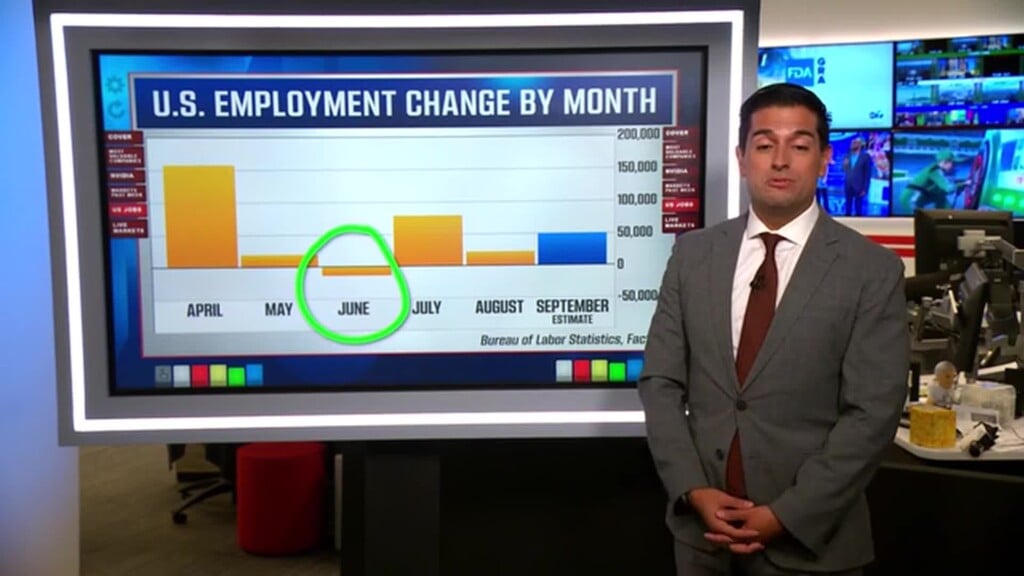

Business reporter Matt Egan notes the slowdown has been stark. “As this chart shows, we’ve seen just this dramatic slowdown in job growth in the U.S. economy,” he said.

The Federal Reserve traditionally relies on incoming economic data to determine whether to raise, cut, or hold interest rates steady. But the ongoing government shutdown has delayed or disrupted some of that information, leaving gaps ahead of next month’s meeting.

“This report is going to go a long way into shaping all those concerns about the U.S. economy and questions about what the Federal Reserve is going to do next,” Egan added.

Even before this latest data, newly released minutes from the Fed’s October meeting show several officials were leaning toward holding rates steady. Rates have already fallen following two cuts earlier this year, and futures markets indicate investors do not expect a third cut at the upcoming meeting.

That expectation comes despite pressure from President Donald Trump, who has urged the Fed to slash rates further to lower borrowing costs. Economists caution, however, that the president’s tariffs are inflationary — and cutting too soon could push prices even higher.